Cosa sono i crediti deteriorati (NPL)? Who supervises my bank? The ECB oversees all significant and. Public consultations. Use the ECB’s online form to report a suspected breach of EU banking supervision law.

This guarantees that the report is submitted directly and without delay to those responsible for assessing the possible breach. Take a look at the ECB’s banking supervision website for more in-depth explainers on this topic. It comprises the ECB and the national supervisory authorities of the participating countries.

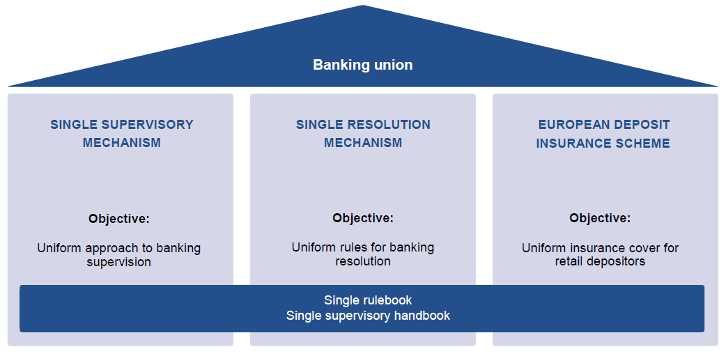

The banking union provides many of the conditions needed for the state to help foster a healthy banking sector. These conditions also make it easier for governments to make tough but necessary decisions when dealing with problematic or failing banks. Kostenlose Kontoführung ohne Mindestgeldeingang. Komfortabler Kontowechsel-Service. It also offers a platform to exchange opinions, as well as to generate ideas to improve Banking.

Български BG Čeština CS Dansk DA Eλληνικά EL Español ES Eesti keel ET Suomi FI Français FR Hrvatski HR Magyar HU Italiano IT Lietuvių LT Latviešu LV M. Browse all ECB press releases on banking supervision. We have updated our privacy policy. We are always working to improve this website for our users. The stress test, covering percent of the EU banking sector, will evaluate the ability of banks in the EU to meet relevant supervisory capital ratios during an adverse economic shock. Financial supervision and risk management.

European and Global Banking. EU co-legislators and the CAs. The EU is examining how to integrate sustainability considerations into its financial policy framework in order to mobilise finance for sustainable growth FinTech New financial technologies (FinTech) can facilitate access to financial services and improve the efficiency of the financial system. Deposit guarantee schemes (DGS) reimburse a limited amount to compensate depositors whose bank has failed. A fundamental principle underlying DGS is that they are funded entirely by banks, and that no taxpayer funds are used.

Under EU rules, deposit guarantee schemes. Modernes Banking und Brokerage, mobile Apps und Beratung. Informieren Sie sich jetzt. ECB allows the ECA full access to information on its banking supervision tasks. BANKING SUPERVISION, RESOLUTION AND RISK MANAGEMENT IN EUROPE 8:a.

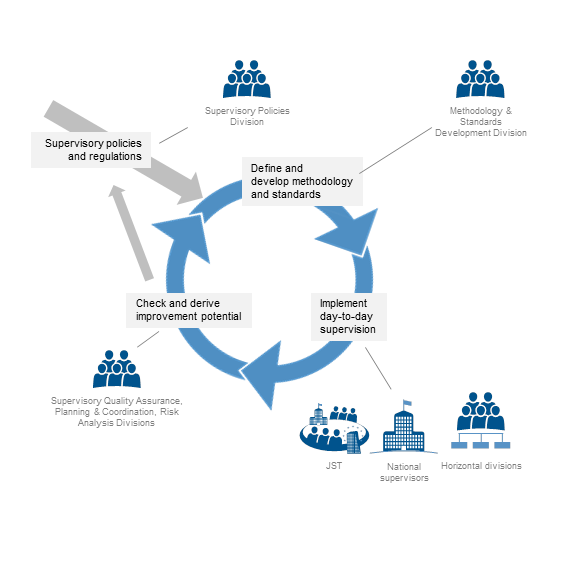

The SRB is the central resolution authority within the Banking Union (BU). Together with the National Resolution Authorities (NRAs) of participating Member States (MS), it forms the SRM. The BCBS work in practice very much as a network of experts in banking supervision taking also into account that any agreement among them requires consensus. This book provides an introduction to EU banking supervision regulations. It seeks to provide a common basis of knowledge for people working in, or studying, banking supervision in the EU , or those unfamiliar with parts of the broad array of banking supervision requirements and instruments.

The focus is on currently applicable regulations. Schau Dir Angebote von.

Keine Kommentare:

Kommentar veröffentlichen

Hinweis: Nur ein Mitglied dieses Blogs kann Kommentare posten.