Entdecken Sie zertifizierte Qualitätstresore für den privaten und gewerblichen Bereich! VdS-zertifizierte Sicherheit. Kostenlose Fachberatung. Diskrete, unauffällige Sicherheit. Ihrer Einrichtung anpasst!

E Parliament and the ECB. ECB Banking Supervision has updated its manual for the Asset Quality Review (AQR) of euro area banks. The manual contains the methodology for assessing the valuations of bank assets from a prudential perspective. The update incorporates the implications of the entry into force of the new accounting standard IFRS 9. In addition, the revised. Browse all ECB press releases on banking supervision.

We have updated our privacy policy. We are always working to improve this website for our users. A repository of solvency and leverage ratios as disclosed by the significant banks is also available for download.

The manual has been written with a focus on IFRS principles, although some banks subject to the AQR may apply national generally accepted accounting principles (GAAP). For these banks, bank teams will be required to align as closely with the manual as is appropriate given national GAAP rules. How to read the QAs in combination with the AnaCredit Regulation and the Manual.

The QAs form part of the AnaCredit Manual. They extend and complement the clarifications already provided in the Manual. Similarly to the rest of the Manual , the QAs have no binding legal status, nor do they. Jetzt unsere Tresore entdecken!

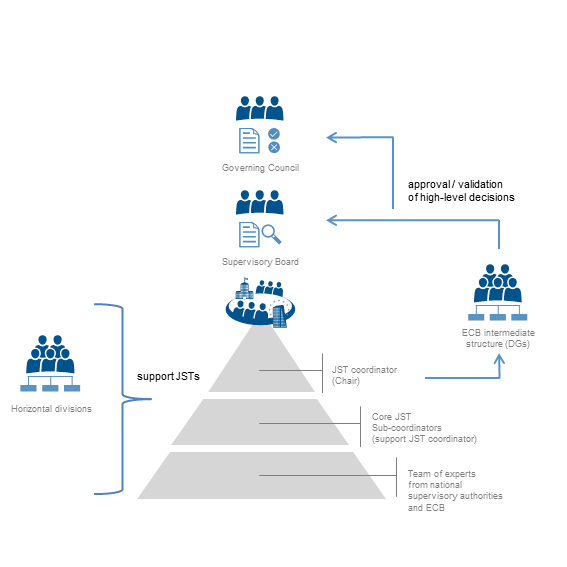

The Manual describes the organisational set-up of the Single Supervisory Mechanism (SSM) and defines the methodologies, processes and procedures for banking supervision in the euro area. It also explains how the SSM cooperates with other authorities in the. The MoU will then be published on the websites of both the ECA and the ECB.

When the ECB determines that direct supervision by the ECB of a supervised entity or a supervised group will en the ECB shall issue an ECB decision to each supervised entity concerned specifying the date and reasons why the direct supervision will end. The ECB shall adopt such decision at least one month prior to the date on which direct. Get a subscription to have access to the whole content. SSM Supervisory Manual - European banking supervision : functioning of the SSM and supervisory approach. It was issued in accordance with the inter Institutional Agreement.

FCA supervision of action by UK RIEs under their default rules REC 4. The section 2power to give directions REC 4. ECB in the coming months and years ahead. It benefited in its analysis from the research undertaken by CEPS staff on bank regulatory and market developments. ECB manual with clear links to EBA-SREP Main elements of the supervisory approach Supervisory planning Strategic planning Strategic priorities (next 1½ year) All information available included: bank level data, benchmark information, analysis an.

The ECB will have its own more detailed supervision manual covering the supervisory approach within the SSM, which will take the form of an internal document addressed to SSM staff. Both the EBA and the ECB will seek to ensure that these two documents are consistent. To ensure efficient supervision , the respective supervisory roles and responsibilities of the ECB and the NCAs are allocated on the basis of the significance of the supervised entities.

All entities under the SSM’s supervision are subject to a common supervisory approach. As part of their ongoing supervision , banking supervision staff also monitor whether institutions have adequate capital to cover risks incurred in respect of on-balance-sheet assets and off-balance-sheet transactions - such as lendings, securities, derivatives or participating interests. Bank Holding Company Supervision Manual.

Provides guidance for conducting inspections of bank holding companies and their nonbank subsidiaries. The supervisory objectives of the inspection program are to ascertain whether the financial strength of the bank holding company is being maintained on an ongoing basis and.

Keine Kommentare:

Kommentar veröffentlichen

Hinweis: Nur ein Mitglied dieses Blogs kann Kommentare posten.